In April 2017, the market capitalization of cryptocurrency was $86.84B. In June 2022, this figure stood at $926B, after hitting a peak of $3048B in November 2021.

Despite the crash of Bitcoin, experts expect it to hit $100,000 before the end of 2022, and newer generations of retail investors are continuing to invest in crypto currency.

Crypto's appeal goes beyond being accepted as an investment asset class. Today, seven types of crypto currency, including Bitcoin, Bitcoin Cash, Ethereum, and Ripple, are also being accepted as alternative digital payments.

This is a welcome move for crypto currency investors who want to do more with their digital currency.

However, one question American taxpayers are asking is - do I need to pay taxes on crypto currency? If yes, how is it taxed by the Internal Revenue Service or IRS? Let's find out!

Yes, Crypto is Taxed!

To the first question, the answer is yes. Crypto currency is taxed by the IRS, and it is important to consider it as a separate wealth creation asset class in your overall portfolio.

Therefore, the income gained from crypto will need to be added to your overall income to arrive at the final figure.

The Spectrum of Crypto Currency

First things first: crypto currency spans a wide range of currencies.

These include Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), Binance Coin (BNB), Binance USD (BUSD), Ripple (XRP), Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Polkadot (DOT), Shiba Inu (SHIB), and Dai (DAI).

However, several lesser-known ones are also attracting retail investors. When considering tax implications, it is important to understand that income from all types of crypto currencies comes under the radar of the IRS.

Crypto is Taxed Like All Capital Gains

When investing in the stock market, a certain amount of unrealized profit or loss shows up on the balance sheet. This notional amount does not land in your bank account unless you sell shares.

However, once you sell shares, you end up with either Short Term Capital Gains (STCG) or Long Term Capital Gains (LTCG), based on whether you sell within a year or after a year.

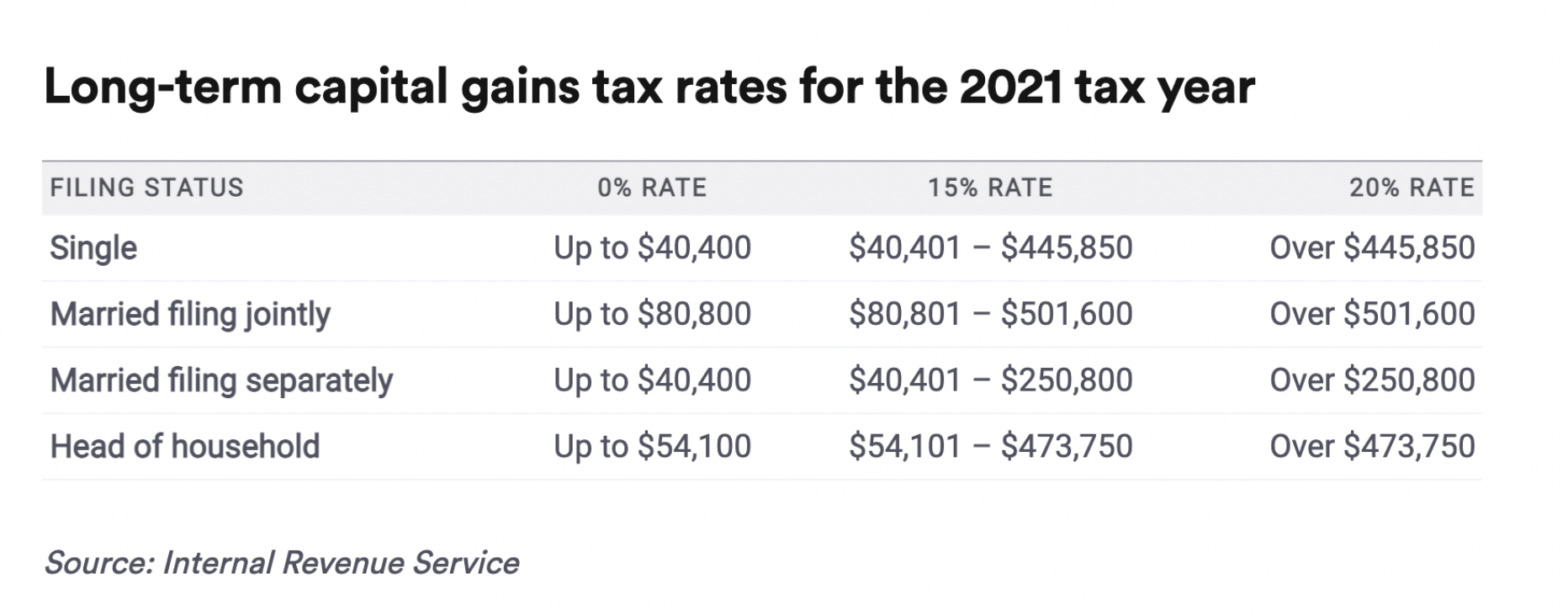

STCG attracts 10 to 37% of tax based on your income tax bracket. On the other hand, if you hold on for a year and then sell, your LTCG attracts a tax of between 0 to 20% based on your income tax slab.

The same rules apply to LTCG and STCG earned on crypto currency investments. Holding on before selling for at least a year reduces your tax liability.

Taxation on Mined Crypto Currency

Some crypto investors are also involved in crypto mining, a sophisticated process of an entrepreneurial nature, where investors participate in creating new currencies.

Many get into crypto mining because of the allure of earning rewards in the form of crypto currency.

Tokens or rewards earned from crypto mining are considered a source of income and must be added to one's income during the filing of taxes.

Crypto and Non-Fungible Tokens (NFTs)

The IRS has not released a detailed and specific guideline for NFTs. However, tax experts observe that taxation on NFTs depends on two aspects: whether you are a creator or investor and whether you are engaging with NFTs as a hobby or a business.

The process of turning a creative piece of work into an NFT is known as minting. If you are a hobbyist and spent crypto currency to mint an NFT and the value of the crypto currency spent on this transaction is much higher than when you purchased it, its current value would attract a capital gains tax.

Whether it can be classified as an LTCG or STCP depends on the time frame of the transaction from when you purchased it. If you minted the NFT as part of your business, it would be treated as part of your income and not as capital gains.

Use a Crypto Calculator

Several well-designed calculators are available to help you understand the tax implications of your crypto earnings. Here are the key details needed:

- Select your filing status - Single, married filing separately, married filing jointly, or head of household.

- Estimated taxable income

- Cost of crypto purchase

- Proceeds from the sale

- Holding period (one year or less)

Say your taxable income is $100,000, and you are filing as a single individual. If you originally invested $100 in crypto, and the proceeds from the sale are $1000 after one year, your LTCG on crypto earnings is $75.

On the other hand, if you sell in less than a year, the STGC is $120. If you file as 'married filing jointly,' then your STGC is $110 due to the marital tax benefit.

Key Tax Forms to Be Filled

The filing deadline to submit 2022 taxes is April 18, 2023. Start planning your filing early on, so your refund can be reinvested into crypto currency.

- First, you will need to fill out Form 8949.

- Add all crypto assets earned as additional income to Schedule 1 Form 1040.

- Conversely, if your crypto earnings are via self-employment, add them to Schedule C.

Submit all forms, and pay your tax before the deadline.

The Takeaway

The taxation of crypto currency is similar to any instrument that attracts capital gains, thus making it less complicated than expected. However, this is an evolving space, with crypto being leveraged by consumers in several ways.

It is advisable to keep an eye on how the IRS evolves its rules over the next few years. Also, don't forget to file your taxes on time to avoid late payments and refund delays. This is an essential part of the journey of making your moolah work for you!