Financial fraud is not something new - it has been around as long as banks have been in existence.

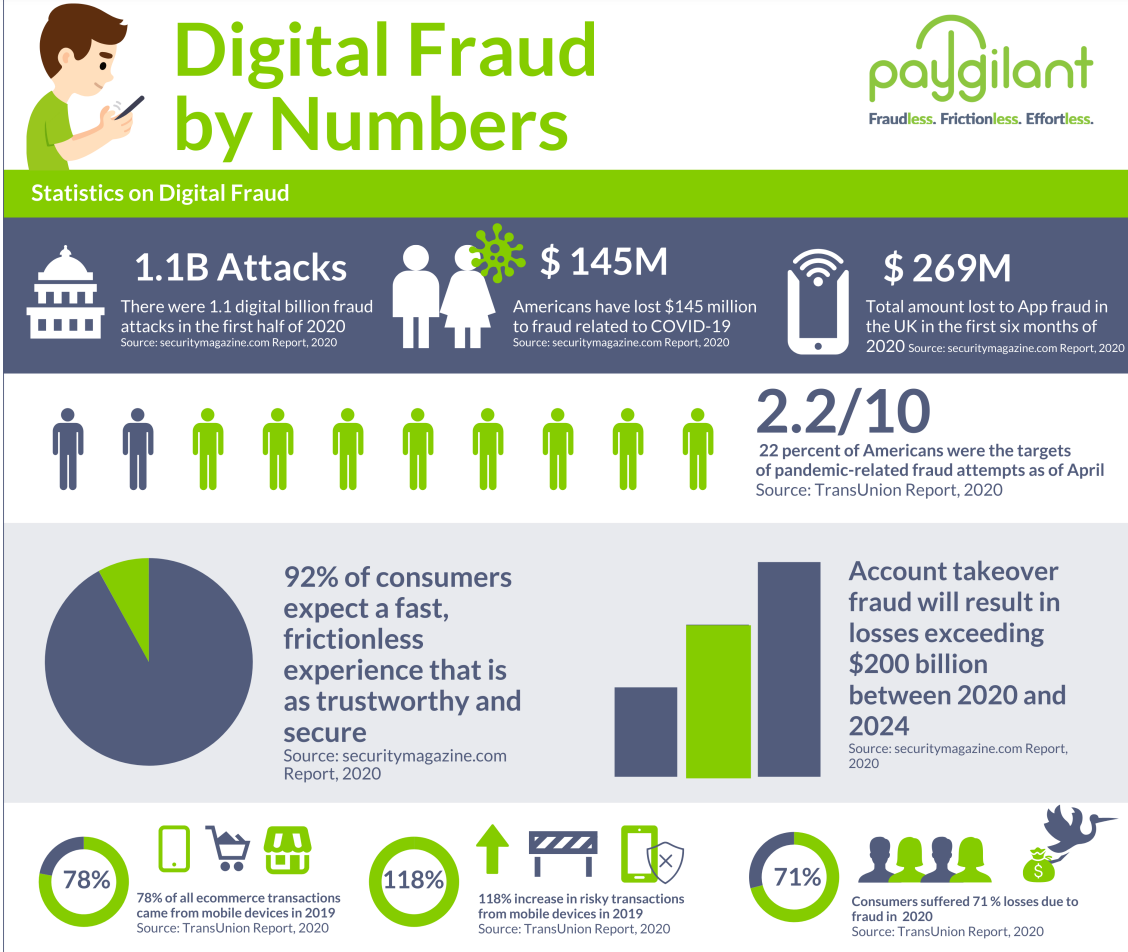

However, the rapid rise of digitization and online banking in the last few years has given a whole new dimension to frauds occurring in the banking sector. This has now become a growing issue with severe consequences for the banking industry in terms of heavy financial losses and dwindling credibility.

A survey conducted by PwC indicated financial losses of a whopping $42B over the past 24 months alone. What’s more worrying is that out of all the financial institutions surveyed, only a little over half said that they detected or investigated their fraud incidents.

To this end, this blog explores fraud detection in the banking sector, common types of fraud in banking, and how intelligent fraud detection works in the banking industry.

What is Intelligent Fraud Detection in Banking?

The ever-growing integration of artificial intelligence or AI into an increasing number of banking systems is well-known.

Intelligent fraud detection in banking refers to the use of these AI-based systems and intelligent algorithms to spot anomalies and fraudulent information quickly to help banks reduce losses and increase productivity in the long run.

An example of this is the deployment of AI and ML systems such as image forensics AI into banking payment channels. The system can detect forgeries, alterations, and counterfeits from simply images of checks and makes it possible to spot and stop instances of fraud efficiently.

In the next section, we will discuss other common types of banking fraud and how banks use intelligent AI to detect them.

Most Common Types of Banking Fraud

The last few years have seen multiple kinds of financial fraud being detected in the banking and financial services industry. Some of the most common types include:

1. Phishing-related Frauds

The Internet Crime Report suggests that people in the US lost as high as $54M in phishing scams in one year alone.

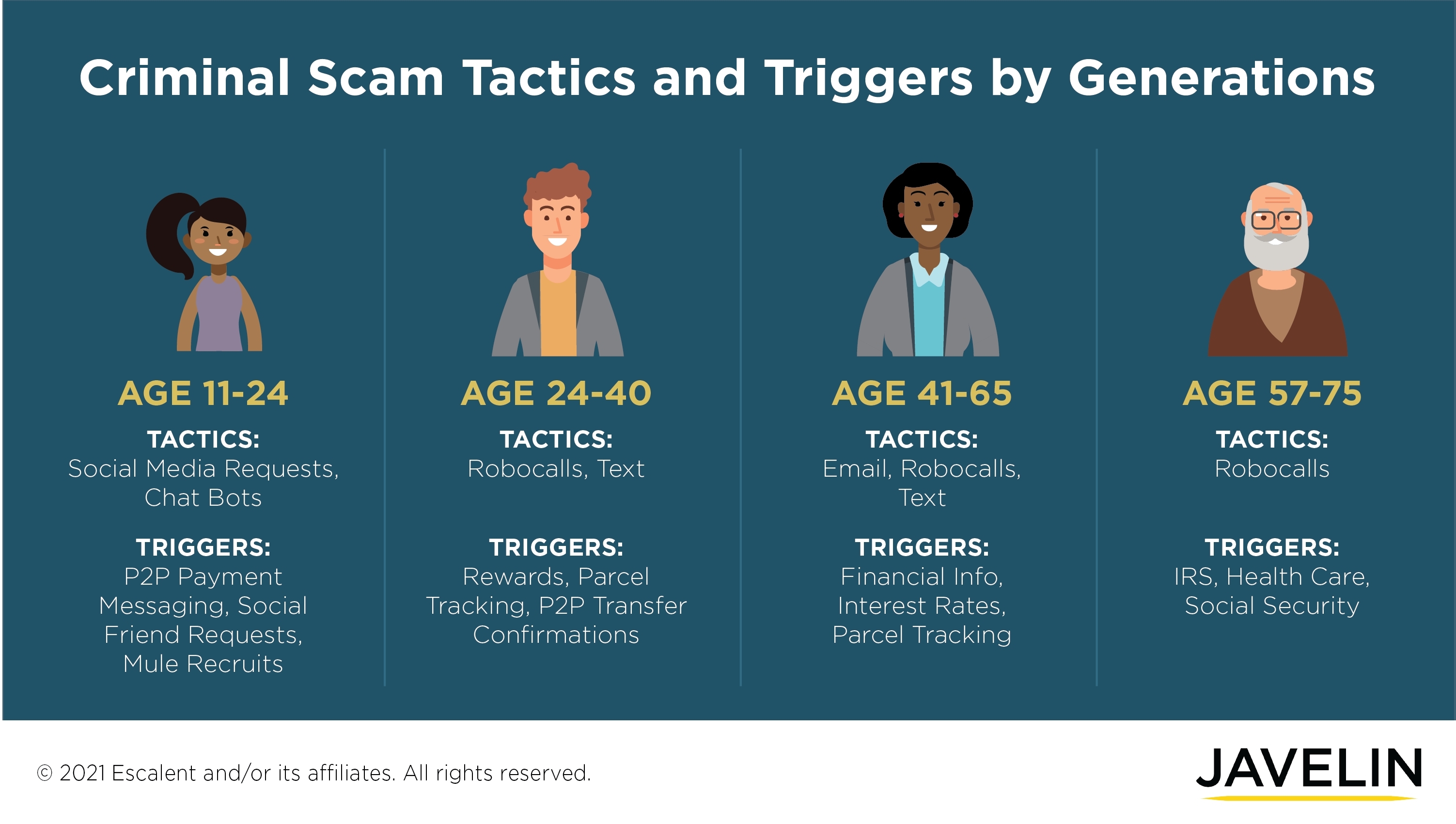

Phishing scams refer to the practice of sending fraudulent communications (emails in most cases) to users that appear to be received from a reputable source.

The goal of phishing attacks is to steal sensitive data such as credit card and login information or to install malware on the victim’s machine.

These attacks can trap both consumers and employees, leading to data breaches, unauthorized transactions, identify theft, and more.

2. Unauthorized Financial Transactions

Unauthorized transactions simply mean banking or credit card transactions that aren’t performed or approved by the account holder. This continues to be a cause of concern to both banks and consumers alike.

Statistics suggest that in 2021, the accumulated value of such unauthorized transactions was estimated to be more than $32B and is expected to increase further to a whopping $38.5B by 2027.

3. Identity Theft

This is another common complaint received by the FTC (Federal Trade Commission) and has a major impact on both consumers and financial institutions.

As per a recent survey, in 2020 alone, the cumulative financial losses from identity fraud were approximately $13B.

How Banks are Using Intelligent AI for Fraud Detection

By employing advanced analytics and machine learning algorithms, banks can identify and prevent fraudulent activities more effectively. Here are some of the key ways banks are using AI intelligence for fraud detection:

Developing Fraud Scores Based on Past Transactions

A fraud detection score is assigned to all customer transactions using relevant data from past financial transactions, risk parameters set by the banks, and various incidents of fraud.

The fraud score here considers a range of different variables, including transaction amount, time taken for the transaction, IP address of the user, frequency of card usage, etc., to accurately assess the risk of fraud.

These fraud scores are then used to approve, flag, or reject a transaction completely. Using AI and machine learning here helps banks improve the accuracy of fraud scores over time.

Building Customer Purchase Profiles

To detect fraud with greater accuracy, banks and financial institutions need to develop a better understanding of customer behavior and accordingly build their purchase profiles.

AI and machine learning make it easy to do this by allowing financial institutions to label and sort massive amounts of data from the past purchase history of buyers.

This, in turn, helps segment customers into various profiles based on the above data, which can then be used to understand customer behavior in detail and help make predictions on future transactions.

As customers make these financial/non-financial transactions, AI helps determine whether or not a particular transaction fits a known pattern/customer behavior or needs to be flagged for irregularities.

Leveraging AI-based KYC

Taking AI-backed KYC measures allows banks to conveniently verify customer identity and documentation, perform instant facial recognition, match fingerprints with higher accuracy, and more.

It serves as a powerful tool that allows banks to keep basic KYC hygiene in place while ensuring customer convenience at the same time.

Investigation of Fraud

AI and ML algorithms are capable of analyzing massive amounts of transactions per second. Neural networks can further augment this capability by making real-time decisions.

These technologies are equipped to successfully identify and segregate the unmanageable number of flagged or suspicious transactions that occur, followed by offering a list of the ones that require further investigation by a human counterpart.

This kind of augmented intelligence can help banking teams prioritize and streamline bank fraud investigations.

Apart from the above, banks and financial institutions also use intelligent AI for fraud analytics to better understand fraud.

For instance, fraud analytics uses data mining, business intelligence, and other fields to develop effective fraud detection solutions through data science.

In Conclusion

When it comes to fraud detection in the banking sector, AI plays a key role in minimizing different kinds of banking thefts to reduce operational losses and build a strong reputation toward the market and customers.

By implementing appropriate AI-driven fraud detection solutions, banking and financial institutions can significantly enhance their fraud detection capabilities.